Home is where the heart is, but we all need a brick-and-mortar structure that we can call our dream home. Returning home from our frequent travels is something we always look forward to, though we love travelling. Home keeps us grounded, it is a place where we can put our feet up, relax and rejuvenate as we get ready for our next travel. And the feeling of returning to a home, which you own is truly special. It is not without reason that buying a home is one of the top life goals of most people.

Table of Contents

Dream Home – From Dreams To Reality

Dreams are desirable and the dream to possess your own home is a desire that everyone has. Dreams are the pointers that guide you towards the task of transforming them into reality. But it is not an easy task to buy or build your own dream home. A combination of hard work, smart thinking, and judicious financial planning is required to get the keys to your dream home, sooner rather than later. You also need to make your own calculations with respect to income, expenditure, and savings, in this connection a good online mortgage calculator would be really helpful.

Your Dream Home – 8 Tips To Own It Faster

We planned early for our dream home. One of the major reasons that drove our decision to invest in a home was the huge amount of expenditure that we were incurring on house rentals. It made a lot of financial sense to us to buy a home so that we could be free of the rent trap. In the bargain, we would also be creating a capital asset which hopefully would appreciate with time. So we answered for ourselves the question of Rent vs Buy and decided to plunge in, and soon our dream had blossomed into reality.

Based on our own experience of buying a home, and our decision to Buy as opposed to Rent, we give here 10 tips that are sure to help you buy your dream home faster. It is also imperative to mention here that the sooner you start the process, the better.

Save Smartly For The Down Payment For Your Dream Home

Most banks and financial institutions give home loans in the range of 80% to 85% of the value of the property that you are proposing to buy. This means that the balance amount is the down payment that you would need to make at the time of applying for the loan. This itself would be a sizable amount and would depend on the cost of the property that you are proposing to buy.

Exercise greater financial discipline and cut down on expenses that are not absolutely necessary and divert all savings towards the amount that you shall need as a down payment.

Budget Smartly

To ensure that you are saving steadily and smartly for your down payment toward your dream house, you would need to analyze where your money is being spent. After identifying the heads of expense, you can categorize them as critical, necessary, and not necessary. Focus on eliminating the expenses that are not necessary. Prepare a monthly budget and ensure that it is being adhered to. This will help you in being on top of your plan to buy your dream home.

Buying a house is not enough but the cost of living should be included in your budget as well. While researching properties, you should consider settling down in Jacksonville as it is an excellent place to call home, read these 9 Reasons To Relocate To Jacksonville, FL.

Invest Smartly

It is not enough to just save, especially in these times when most economies are struggling and inflation is rampant. What is also required are smart investments, that will ensure that your savings grow faster. There are many safe investment options like specific Mutual Funds that offer better returns than your savings bank. Take professional advice and invest a portion of your savings prudently.

Research Smartly

It is important to know beforehand what type of home you are looking for. Based on your own estimated budget, research properties that are on the market. Match them with your own preferences and do a cost-benefit analysis and comparison. Decide on whether you want to invest in an apartment or an independent house. The prices are again dependent on location. For example, a house of the same size may be cheaper on the outskirts of the city as compared to the heart of the city. Your research needs to take all parameters into consideration before you finally zero in on your dream home.

Plan Smartly For Your EMI’s

It is not enough to plan and save for your down payment, you must also be aware of and plan for the future EMI’s that will start once your home loan is disbursed. This would be a regular item of expense for the duration of the term of the home loan, and hence you would need to proactively factor that into your budget. You could also look at alternate sources of income to supplement your monthly income to take care of the additional outflow.

Be Ready For Incidental Expenses

It is common to forget the details and focus on the big picture while planning for your dream home. You might have planned for your down payment and EMI’s, but it is good to be aware that there will be many incidental expenses, which though individually small can add up to a significant amount. These include the likes of stamp duty and registration charges, legal charges, municipal taxes, conversion fees, document charges, etc. It is good to be aware of them beforehand, rather than be surprised at the last moment.

Smartly Analyze Home Loan Options

Choosing the right home loan provider is also very important and a smart choice can result in substantial savings for you, both in the short and long terms. There are many banks and other financial institutions in the market that are sure to vie with each other in offering you a home loan. Do not jump at the first offer, rather do a comparative study of all factors, like rate of interest, administrative charges, percentage of the loan being offered, tenure, monthly EMI, interest calculation method, documentation and legal formalities, etc. Decide on the best option that suits you only after a thorough analysis.

Factor In Income Tax Benefits

If you are buying a home, it is not all about money outflow. There are many indirect and direct benefits. There are income tax benefits that you can avail of when you have taken a home loan. If you are planning to rent out the house, you have to factor in the rental receipt. If you are going to stay in the house, you will be also saving on your house rent which otherwise you would have been paying monthly. These factors are important to consider, especially when you are comparing renting a house vs buying a house.

We are sure that these steps will help you in realizing the dream of your own dream house faster. Do let us know your thoughts through our comments section. For more informative and interesting content, subscribe to our blog, and also follow our social media handles.

Do You Love Traveling?

Do you want to know how to travel the world? We have put together a very useful travel resources page with the best travel tips. Go check it out now. Thanks for visiting our site Voyager - imvoyager.com and taking the time to read this post! If you wish to collaborate/work with us then reach us at imvoyager18@gmail.com We’d love it if you’d comment by sharing your thoughts on this post and share this post on social media and with your friends. Follow our journey on our social media channels: Facebook X Instagram Pinterest YouTube

Start dreaming about your next adventure with Tripadvisor. Book your next unforgettable experience here with flexible bookings and free cancellations.

Flight booking online at the best fare

60+ Million Users Trust TripAdvisor With Their Travel Plans. Shouldn't You?

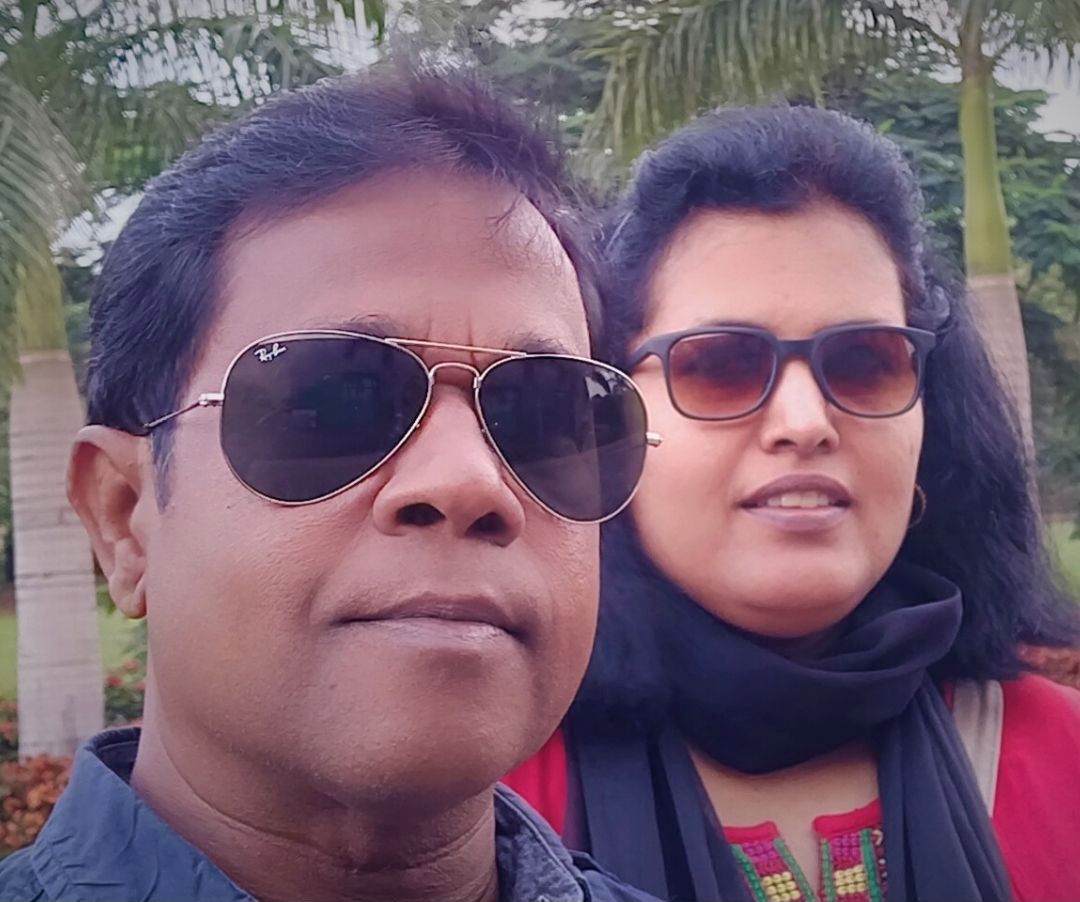

Sandy & Vyjay are a husband and wife duo who are travel content creators. They are co-founders of this travel website and are one of the leading travel content creators in India.

Sandy & Vyjay quit their successful corporate careers to pursue their passion for travel and writing full-time. Their dedication has earned them the “Best Travel Writer” award and numerous accolades on both national and international stages. Focusing on India’s destinations, heritage, and culture, they are passionate advocates for nature and the environment. Through their content, they promote ecotourism and sustainable travel, inspiring others to explore and preserve the beauty of India.