Life is a great gift and one needs to enjoy it. For this, one of the most important requirements is good health. When we talk about health, it is not only physical health but also financial health. One needs to be financially fit to ensure a good life for oneself and family.

How does one ensure a financially fit and healthy life?

Here are a few life hacks that will definitely help in achieving the objective of being Financially Fit:

- Ensure that your income is more than your spending. What this simply means is do not spend everything you earn, save for a rainy day

- Make sure you are financially literate. What this means is, not only be adept at earning money but more importantly, learn how to save and make the savings grow

- Identify good opportunities and do not hesitate to take calculated risks

- Never borrow money just for enhancing your lifestyle, borrow only for investments

- Plan for the short term and the long term

The important thing to bear in mind is to plan your investments well. One needs to plan for various events in one’s life ranging from marriage to children to children’s education etc. One also needs to plan for retirement and also any untoward eventuality that could affect a family. It is always important to strike the right balance between returns and security. Insurance is one avenue which is a long term investment. It takes care of both returns on investment and security.

When it comes to insurance, we all have one common question in our minds. We are always in a dilemma about what the right amount to invest for insurance is and how to balance between insurance and savings. It is always nice to have help and expert guidance at hand, especially in areas in which you are no expert.

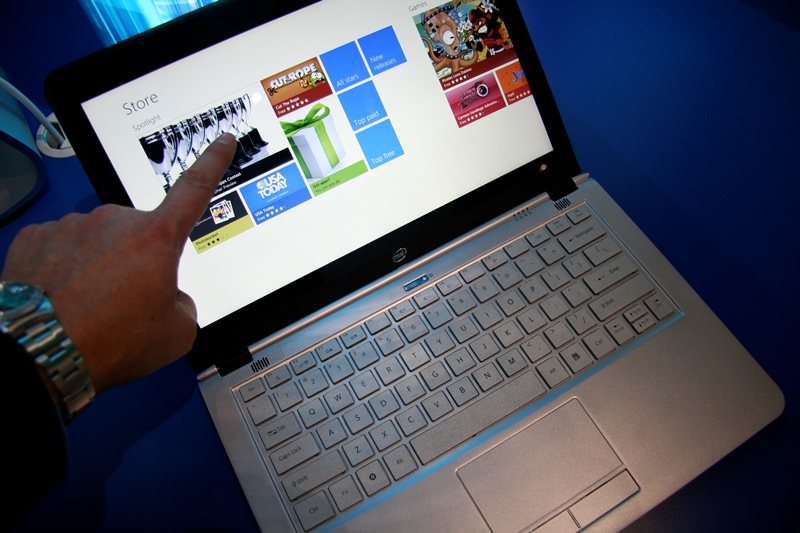

I recount here my recent experience of buying insurance. I wanted to buy the most appropriate insurance for my needs, but I was totally confused on what I wanted. Given my tight schedules at work, I did not have the time for a detailed discussion with an agent neither did I have the patience for loads of paperwork. It was then that I came across HDFC Life and their wide range of insurance plans. I found out that you had all information at your fingertips and you could literally Click to Insure!

#YehBhiOnline I thought and it really pleased me as I was a big fan and advocate of online transactions for everything ranging from shopping for shoes and clothes to paying taxes.

I took the first baby step and clicked on HDFC Life’s Click To Insure. What I saw on the site immediately swept away all my hesitation and fear of venturing into unknown territory. I found that by just keying in a few basic information, I was recommended a choice of plans most suited for me. In addition, there were a whole set of tools, like Online Insurance Calculator, Insurance Premium Calculator, Savings Plan Calculator, Retirement Planner Calculator and many others. I was also pleasantly surprised to find that insurance was not so expensive as I had thought, it cost as low as Rs. 18/day for a Rs. 1 Crore cover. The best thing was that there was always someone available virtually to help you, through a chat or call back. In fact, once I had decided on the plan, the customer care executive actually helped me complete the form through screen sharing. I felt buying insurance could not be easier and convenient than this. Not only buying insurance, but the post sales support was also available at the click of a mouse. The site also has online premium payments and claims functionality.

I went ahead and bought myself peace of mind and financial stability by the click of a mouse as I marveled at the thought #YehBhiOnline. I bought HDFC Life insurance, a critical aspect of life with the click of a mouse or should I say Click to Insure!

We’d love if you’d comment and share this post.

Get MORE Visitors/Traffic To Your Website!

[pinit color=”red” size=”large” rectangular=”rectangular”]

Add to Flipboard Magazine.

All things that seem like common sense but, unfortunately, you don’t see very often. I need to become more financially literate!

Live within your means is more like it. It’s important that you are aware of these tips that you have here because they’re really going to help you save and stick to your budget.

It’s good to have a financial plan it helps you get ready for anything that you’ll do in life, from having kids to starting a business and so on. It’s also important to spend only what you can spend.

This is absolutely an interesting post for me and I love the helpful information. Glad you share this

Good read as i really need something like this. I need a motivation to start anew and getting an insurance is a good one to start.

I agree with your post. I never liked going beyond my means financially, unless it’s for a good cause. It also pays to read about money. It’s taboo in my culture, but it’s something to arm yourself with. You deal with money everyday!

Such simple but so thoughtful tips like just earn more, spend less..yet many people struggle. Just because they don’t have the awareness. Thanks for putting up the information. Will definitely help many

It’s true that you should plan always in your finances, especially when traveling. It gives you more time to save, as well as foresee things if it is worthy spending on or not.

Agree with the importance of learning about handling finances. With so may tips and guides on becoming more financially-savvy, there is one attitude that is also critical to making all the others happen. And that is to have the discipline to control one’s impulses. It is also this discipline that allows one to go for delayed gratification. I have written about this in the past, but unfortunately, more people today value instant gratification.